#!/usr/bin/env python

# coding: utf-8

# In[1]:

get_ipython().run_cell_magic('javascript', '', '\nIPython.OutputArea.prototype._should_scroll = function(lines) {\n return false;}\n')

# # 7 Equilibrium in the Flexprice Model

#

# #### QUESTIONS

#

# 1. In the flexible-price model, what keeps aggregate demand and the level of production equal to potential output?

# 2. In the flexible-price model, what makes the supply of funds—saving—equal to the demand for funds—investment—in financial markets?

# 3. When saving or investment demand changes, what happens n the flexible-price model to the real interest rate, and why?

# 4.As government policies, the international economic environment, or other features of policy or the economic environment change, what happens in the flexible-price model to^consumption, investment, government, and gross and net export spending?

#

#

#

# **financial markets**: The stock market, the bond market, the short-term borrowing market, plus firms' borrowings from banks.

#

# **total saving** private saving plus government saving (the government's surplus; government saving is negative when the government runs a deficit) plus foreign saving.

#

# **private saving** Equal to households' disposable incomes (which include earnings retained

# by corporations and then reinvested) minus their consumption spending. Household saving includes both saving done directly by households and saving done on their behalf by firms whose stock they own.

#

# **government saving**: The government's budget surplus. Government saving is negative when the government runs a budget deficit.

#

# **foreign saving**: The net amount of money that foreigners are committing to buying up property and assets in the home country. Equal to minus net exports.

#

# **capital inflow**: Net investment by the citizens of one country in another—the "flow" of financial capital from one country to another.

#

# **crowding out**: Decreases in investment spending caused by a drop in government saving that leads to higher real interest rates.

#

# ----

#

#

# ## 7.1 Full-Employment Equilibrium

#

# Chapter 6 set out the determinants of the components of total spending. But knowing what determines consumption spending C, investment spending I, and net exports NX is not enough for understanding the macroeconomy. The macroeconomy is a system. The determinants of net exports are affected indirectly by the level of investment spending. Investment spending cannot be analyzed without knowing what has happened to consumption spending. But consumption spending depends on income, which in turn depends on the levels of net exports and investment spending.

#

# We need a way of analyzing the macroeconomy as an interdependent system, rather than as a collection of parts we stack next to each other. What are the forces in the economy that make aggregate demand equal output? This question has two answers. One answer is correct when we assume prices, wages, and debts are fully flexible. A second—different—answer is correct when we assume that they are "sticky".

#

# Starting in Chapter 9, we will look at the sticky-price model of the macroeconomy. In this chapter, we assume prices, wages, and debts are fully flexible.

#

#

#

# ### 7.1.1 Price Flexibility

#

# The key assumption that separates how we analyze equilibrium in this chapter from our analysis that begins in Chapter 9 is the assumption of price flexibility. In this chapter, we assume prices are fully flexible. We must confess: This assumption is not a realistic description of the short run. We use it because assuming prices are flexible is very helpful for analyzing the economy in the long run.

#

#

#

# #### 7.1.1.1 If Prices Were Truly Flexible: Some Details

#

# What does it mean for prices to be flexible? The authors work in Berkeley, where sometimes it seems every student in a morning class arrives with a paper coffee cup in hand. The lines at one of the most popular cafes, Caffe Strada, typically go out the door just before the 10:00 a.m. classes begin. Everyone in line needs to have their cappuccino, latte, or espresso if they’re going to make it through class. This is especially the case on our foggy, chilly mornings in late spring.

#

# If prices were fully flexible, the price of the coffee drinks would rise between the time the last student got in line and the time she reached the counter. The chill in the air increased demand. The time (morning) increased demand. In a world of fully flexible prices, the price of the product would respond by rising immediately. As you stood there, waiting to reach the counter, you’d see the price of your coffee drink rise. But 45 minutes later, when the sun had burned off the fog so the chill in the air was gone, and when everyone was already in class, the subsequent fall in demand would lead to falling prices. That swing in prices in immediate response to changes in demand would be an example of fully flexible prices.

# This is, of course, an example on a micro scale. When the same story applies in industry after industry, then you have a macro story.

#

# If prices, wages, and debts were to be fully flexible across the macroeconomy, the amount of output the economy produces Y is always equal to its potential output Y*. So what guarantees that, in a flexible-price economy, this full-employment level of output will also be an equilibrium level of output, where output equals aggregate demand?

#

# It is the real interest rate r that adjusts to ensure full-employment equilibrium in a flexible-price macroeconomy. Now we will see why and how:

#

#

#

# ### 7.1.2 The Flow-of-Funds Approach

#

# We saw in Chapter 6 that the real interest rate determines investment spending. Also, the real interest rate determines the real exchange rate $ \epsilon $, and this real exchange rate determines net exports. What you will learn in this chapter is that the real interest rate changes and adjusts to make the demand for output equal to the available output—which in this flexible-price economy is potential output Y*. What causes the real interest rate to change and adjust and to rapidly be at the level consistent with full-employment equilibrium? Supply and demand in financial markets cause this as purchasing power—funds—flow into and out of the markets in the economy that finance production and consumption. Thus we call this the flow-of-funds approach to understanding macroeconomic equilibrium in a flexible-price economy.

#

# What is the real interest rate that plays this role? The real interest rate is the price that a lender charges to provide and the price that a borrower pays to acquire financing, which is the social power to control the commitment of resources. Finance flows through the financial markets as savers try to find a productive, profitable, and interest-, dividend-, or capital gains-earning place to put their savings; and as businesses try to find cheap financing for the investment projects they undertake in the hope that they will become profitable.

#

# Why do some people and organizations provide finance—lend money? Because they have no immediate spending use for it, and receiving some interest is better than having it sit under the mattress. Why do businesses borrow money? They borrow money because they hope to make a profit by using the funds they borrow to invest in new plant and equipment in order to expand their operations.

#

# Thus the saving of households and others flows into the financial market, and the borrowing of businesses seeking to finance investment flows out of financial market. The real interest rate is the price charged and received in the financial market. Loanable funds are the commodity that is traded in this market: control over purchasing power today under the condition that such control is only temporary, and that the control over purchasing power will have to be returned—that the loan will have to be paid back.

#

# When the interest rate is at its long-run equilibrium level, the supply of loanable funds equals the demand for loanable funds. The financial market is then in balance.

#

#

#

# #### 7.1.2.1 The Paradox of Thrift

#

# Chapter 4, recall, presented a truly long-run economic model, a model of economic growth. Remember—or review—that when the saving rate increases in such a long-run model, the capital-output ratio increases to its new steady-state balanced growth-path equilibrium value. More saving thus produces a higher level of productivity and standard of living. But Chapter 4 had no story about how an increase in saving produces a higher capital-labor ratio—it assumed that more savings by individuala automatically translated into higher investment by businesses and a faster-growing capital stock. But there was no clear and explicit mechanism.

#

# There was thus a gap in the argument of Chapter 4. What if there is no mechanism, or if the mechanism fails? What if purchasing power flows into the financial market as households and organizations seek to not consume but save, but the flow of purchasing power out of financial markets is not of equal magnitude? Then savers cannot find enough in the way of investments—stocks, bonds, real estate portfolios, loans—and so they seek to hold some other asset that will allow them to save and thus to carry their purchasing power from the present into the future. What is that other asset? It is cash: money. And so if there is no mechanism—or if the mechanism fails—we then have that excess demand for money that British economist John Stuart Mill put his finger on in 1829 as the cause of a high-unemployment depressed-production "general glut":

#

# >Persons... at that particular time... liked better to possess money than any other commodity. Money, consequently, was in request, and all other commodities comparative disrepute... the result is, that all commodities fall in price, or become unsaleable...

#

# If there is no effective mechanism, then increases in desired savings from households and organizations unaccompanied by parallel increases in desired investment spending by businesses can fail to enrich but rather impoverish an economy by causing a depression. John Maynard Keynes (1936) noted in his _General Theory of Employment, Interest, and Money_ that this "paradox of thrift" was of great concern to Thomas Robert Malthus, who argued that the idea that more savings automatically and necessarily generated more investment and greater wealth "of all the opinions advanced by able and ingenious men... appears to me to be the most directly opposed to just theory, and the most uniformly contradicted by experience"; that this paradox most prominently advocated in Bernard de Mandeville's (1721) _Fable of the Bees_, but can be traced back more than a century earlier to Barthelemy de Laffemas's (1598) _Les Trésors et Richesses pour Mettre l'Estat en Splendeur_.

#

# Here, however, in the flexprice model of Chapter 7, there is no "paradox of thrift". Here we fill that gap in the Chapter 4 argument. Here there is a mechanism. Chapter 7 provides this answer: the real interest rate is the price that adjusts to ensure that supply and demand are in balance in the flow-of-funds through the fionancial market, and thus that increases in savings lead to more investment. You will learn in this chapter that when saving increases, real interest rates decline, and so investment spending increases. And more investment in plant and equipment produces a larger capital stock, which in the very long run increases the capital-labor ratio, the capital-output ratio, and output per worker.

#

# But this only works when prices, wages, and debts are none of them "sticky".

#

# Note, therefore that there will be a certain tension in this chapter. Prices are flexible; the time scale of the analysis must be long enough for prices to adjust so that there is no excess demand or excess supply in any of the economy’s markets. So this analysis of Chapter 7 applies to changes in the economy only if they take significantly longer than a month or a quarter. On the other hand, we are going to assume that potential output Y* does not change, which means that the analysis of Chapter 7 applies to changes in the economy only if they take significantly less than a decade. The usefulness of the flexible-price model thus tends to get squeezed between the sticky-price fluctuations model covered in later chapters and the long-run growth model covered earlier.

#

# But before we get too far ahead of ourselves, let’s build the model.

#

#

#

# ### 7.1.3 RECAP: Full-Employment Equilibrium

#

# In a flexible-price economy, real output Y always equals potential output Y*. At equilibrium in output markets, this potential output will equal aggregate demand; this is the flow-of-output approach. We can also look at equilibrium with the flow-of-funds approach; saving equals investment in equilibrium. Changes in the real interest rate will take the economy to equilibrium.

#

# ----

#

#

# ## 7.2 Two Approaches, One Model

#

# ### p, government saving Sg, and foreign saving by the rest of the world Sf. So through the financial markets, total saving S equals investment I. This is the flow-of-funds approach to equilibrium.

#

# The sum of consumption spending (pink flow from households), government spending (pink flow from government), investment spending (pink flow from financial markets), less the net imports (red flow to rest of the world) flows into businesses. This is aggregate demand. Businesses produce output in response to this aggregate demand. So through the output markets, aggregate demand equals output. This is the flow-of-output approach to equilibrium.

# And the output produced by businesses generates income for households. Off we go on another round through the circular flow.

#

# The circular flow diagram is one way to understand that the flow-of-funds and flow-of-output approaches to the macroeconomy are equivalent. We can also demonstrate that equivalence a second way: algebra.

#

#  #

# >**The Circular Flow Diagram**: This version of the circular flow is complicated by the addition of the government and financial markets to the diagram. Not all final goods and services are bought by households. Some are bought by the government, which taxes to raise resources to finance itself. Some are bought by businesses seeking to invest, which raise the needed resources by issuing stock, issuing bonds, and borrowing—all of which take place in financial markets. This version is also complicated by its recognizing that there is a world outside, a world that buys the products of domestic businesses and that invests through domestic financial markets.

#

#

#

# ### 7.2.3 Using Some Algebra

#

# We start from the familiar flow-of-output equilibrium condition, and derive the flow- of-funds equilibrium condition. Begin with the definition of aggregate demand AD:

#

# >AD = C + I + G + NX

#

# Under the flow-of-output approach, aggregate demand AD and output Y are equal in macroeconomic equilibrium. When wages and prices are flexible, then output Y equals the economy’s potential productive output Y*. So in flow-of-output equilibrium, potential output Y* will equal aggregate demand AD. We have

#

# >Y* = C + I + G + NX

#

# Now a few steps will take us to the equivalent flow-of-funds equilibrium statement. Subtract consumption C, government purchases G, and net exports NX from both sides in order to move everything except investment spending I to the left-hand side:

#

# >Y* - C - G - NX = I

#

# And then a little math trick will give us economically meaningful concepts: Subtract and add net taxes T on the left-hand side by subtracting it from income Y* and adding it to — G. Add some parentheses so we can group terms by economic concepts:

#

# >(Y* —T —C) + (T —G) + (-NX) = I

#

#

#

# ### 7.2.4 Unpacking the Flow-of-Funds Equation

#

# Now let’s step back and look at what this flow-of-funds equation means.

#

# The right-hand side of this equation is simply investment spending I. In the circular flow approach, investment spending is simply spending by firms to build factories and structures and boost their productive capacity. But under the flow-of-funds approach, we think of investment I not as the output that businesses buy, but as the funds that businesses allocate to buying these investment goods. Investment spending I is the flow of funds out of financial markets to businesses, which then use the funds to undertake investment. It is the demand for loanable funds.

#

# The left-hand side of the equation measures the total saving flowing into financial markets from three different groups—private savings via households (which, remember, include not only the workers but also the owners of businesses, and the businesses themselves because they are acting as agents for their owners), the government, and the rest of the world.

#

# The first term:

#

# > $ Y^* — T — C $

#

# is equal to private household saving Sp. In this flexible-price model, potential output Y* is equal to real output. Output and household income are always equal. So Y* is just household income. Subtract net taxes T and consumption spending C from household income Y* and what is left? What is left is private saving—the flow of funds from households into financial markets — because saving is the only thing that households do with income, other than pay it to the government as taxes and spend it on consumption goods.

#

# The second term

#

# > $ T — G $

#

# is equal to government saving Sg. T is simply the taxes the government collects minus the transfer payments it makes to individuals. G is government purchases. So T — G is the difference between the taxes that the government collects and the transfer payments and purchases the government makes. When T-G is positive, the government is running a budget surplus. The surplus is government saving SG. When T —G is negative, the government is running a deficit (as it is today). Then SG will be less than zero.

#

# The last term—the opposite of net exports, -NX—is foreign saving Sf, saving by foreigners directed into the United States. It is the capital inflow, the net flow of funds that the rest of the world channels into domestic financial markets. Net exports are the difference between the dollars foreigners spend buying our exports and the dollars earned by foreigners selling us imports. If net exports are less than zero—which they typically are for America—foreigners have dollars left over after they buy all our exports they want. These internationally owned dollars flow into financial markets. They aren’t spent buying our exports, and the only other useful thing the rest of the world can do with them is save them. (When net exports are positive, this term has a different interpretation. It is the net amount of domestic saving that is diverted into international financial markets—the amount of saving that does not show up as loanable funds available to finance investment at home, but instead finances investment abroad.)

#

# We have derived the flow-of-funds equilibrium equation. The three left-hand side terms of

#

# > $ (Y^*-T-C)+(T- G)+(~NX)=I $

#

# are the three flows of purchasing power into the financial markets: private saving, government saving, and foreign saving. Added together they make up total saving S, which is the supply of loanable funds. The demand for loanable funds is simply investment spending I, the right-hand side of the equation above. So the flow-of-funds equilibrium equation can also be written

#

# > $ S^p + S^g + S^f = I $

#

# What we have shown is that the circular-flow equilibrium condition—output equals aggregate demand—is equivalent to the flow-of-funds equilibrium condition—saving equals investment. When one statement is true, the other must also be true. When one is false, the other must also be false. If supply equals demand in the market for loanable funds

#

# > $ S^p + S^g + S^f = I $

#

# then aggregate demand in the flexible-price economy is equal to full-employment output. And if output equals aggregate demand in the markets for goods and services, then

#

# > $ Y^* = C + I + G + NX $

#

#

#

#

#

# >**The Circular Flow Diagram**: This version of the circular flow is complicated by the addition of the government and financial markets to the diagram. Not all final goods and services are bought by households. Some are bought by the government, which taxes to raise resources to finance itself. Some are bought by businesses seeking to invest, which raise the needed resources by issuing stock, issuing bonds, and borrowing—all of which take place in financial markets. This version is also complicated by its recognizing that there is a world outside, a world that buys the products of domestic businesses and that invests through domestic financial markets.

#

#

#

# ### 7.2.3 Using Some Algebra

#

# We start from the familiar flow-of-output equilibrium condition, and derive the flow- of-funds equilibrium condition. Begin with the definition of aggregate demand AD:

#

# >AD = C + I + G + NX

#

# Under the flow-of-output approach, aggregate demand AD and output Y are equal in macroeconomic equilibrium. When wages and prices are flexible, then output Y equals the economy’s potential productive output Y*. So in flow-of-output equilibrium, potential output Y* will equal aggregate demand AD. We have

#

# >Y* = C + I + G + NX

#

# Now a few steps will take us to the equivalent flow-of-funds equilibrium statement. Subtract consumption C, government purchases G, and net exports NX from both sides in order to move everything except investment spending I to the left-hand side:

#

# >Y* - C - G - NX = I

#

# And then a little math trick will give us economically meaningful concepts: Subtract and add net taxes T on the left-hand side by subtracting it from income Y* and adding it to — G. Add some parentheses so we can group terms by economic concepts:

#

# >(Y* —T —C) + (T —G) + (-NX) = I

#

#

#

# ### 7.2.4 Unpacking the Flow-of-Funds Equation

#

# Now let’s step back and look at what this flow-of-funds equation means.

#

# The right-hand side of this equation is simply investment spending I. In the circular flow approach, investment spending is simply spending by firms to build factories and structures and boost their productive capacity. But under the flow-of-funds approach, we think of investment I not as the output that businesses buy, but as the funds that businesses allocate to buying these investment goods. Investment spending I is the flow of funds out of financial markets to businesses, which then use the funds to undertake investment. It is the demand for loanable funds.

#

# The left-hand side of the equation measures the total saving flowing into financial markets from three different groups—private savings via households (which, remember, include not only the workers but also the owners of businesses, and the businesses themselves because they are acting as agents for their owners), the government, and the rest of the world.

#

# The first term:

#

# > $ Y^* — T — C $

#

# is equal to private household saving Sp. In this flexible-price model, potential output Y* is equal to real output. Output and household income are always equal. So Y* is just household income. Subtract net taxes T and consumption spending C from household income Y* and what is left? What is left is private saving—the flow of funds from households into financial markets — because saving is the only thing that households do with income, other than pay it to the government as taxes and spend it on consumption goods.

#

# The second term

#

# > $ T — G $

#

# is equal to government saving Sg. T is simply the taxes the government collects minus the transfer payments it makes to individuals. G is government purchases. So T — G is the difference between the taxes that the government collects and the transfer payments and purchases the government makes. When T-G is positive, the government is running a budget surplus. The surplus is government saving SG. When T —G is negative, the government is running a deficit (as it is today). Then SG will be less than zero.

#

# The last term—the opposite of net exports, -NX—is foreign saving Sf, saving by foreigners directed into the United States. It is the capital inflow, the net flow of funds that the rest of the world channels into domestic financial markets. Net exports are the difference between the dollars foreigners spend buying our exports and the dollars earned by foreigners selling us imports. If net exports are less than zero—which they typically are for America—foreigners have dollars left over after they buy all our exports they want. These internationally owned dollars flow into financial markets. They aren’t spent buying our exports, and the only other useful thing the rest of the world can do with them is save them. (When net exports are positive, this term has a different interpretation. It is the net amount of domestic saving that is diverted into international financial markets—the amount of saving that does not show up as loanable funds available to finance investment at home, but instead finances investment abroad.)

#

# We have derived the flow-of-funds equilibrium equation. The three left-hand side terms of

#

# > $ (Y^*-T-C)+(T- G)+(~NX)=I $

#

# are the three flows of purchasing power into the financial markets: private saving, government saving, and foreign saving. Added together they make up total saving S, which is the supply of loanable funds. The demand for loanable funds is simply investment spending I, the right-hand side of the equation above. So the flow-of-funds equilibrium equation can also be written

#

# > $ S^p + S^g + S^f = I $

#

# What we have shown is that the circular-flow equilibrium condition—output equals aggregate demand—is equivalent to the flow-of-funds equilibrium condition—saving equals investment. When one statement is true, the other must also be true. When one is false, the other must also be false. If supply equals demand in the market for loanable funds

#

# > $ S^p + S^g + S^f = I $

#

# then aggregate demand in the flexible-price economy is equal to full-employment output. And if output equals aggregate demand in the markets for goods and services, then

#

# > $ Y^* = C + I + G + NX $

#

#

#

#  #

# >**The Flow of Funds through Financial Markets**: Private saving, government saving, and foreign saving flow into financial markets. These funds flow out of financial markets to businesses, which use the funds to finance investment demand—the purchase of new plant and equipment.

#

#

#

#

#

# >**The Flow of Funds through Financial Markets**: Private saving, government saving, and foreign saving flow into financial markets. These funds flow out of financial markets to businesses, which use the funds to finance investment demand—the purchase of new plant and equipment.

#

#

#

#  #

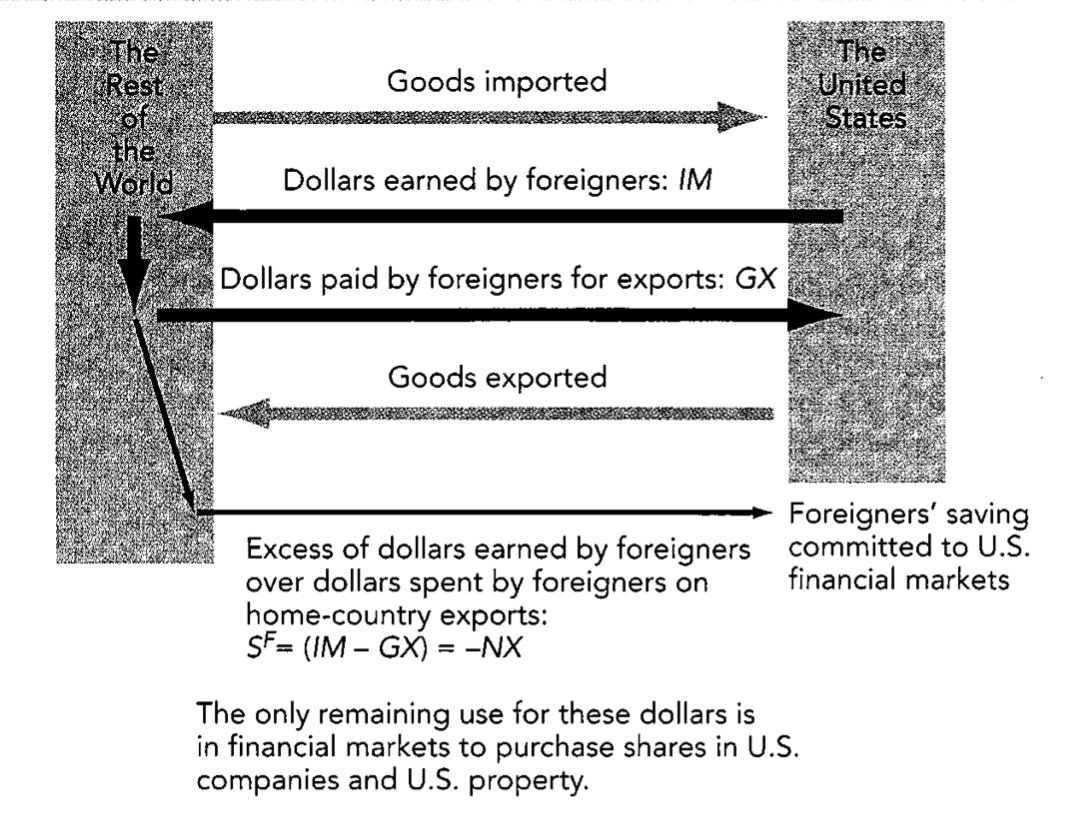

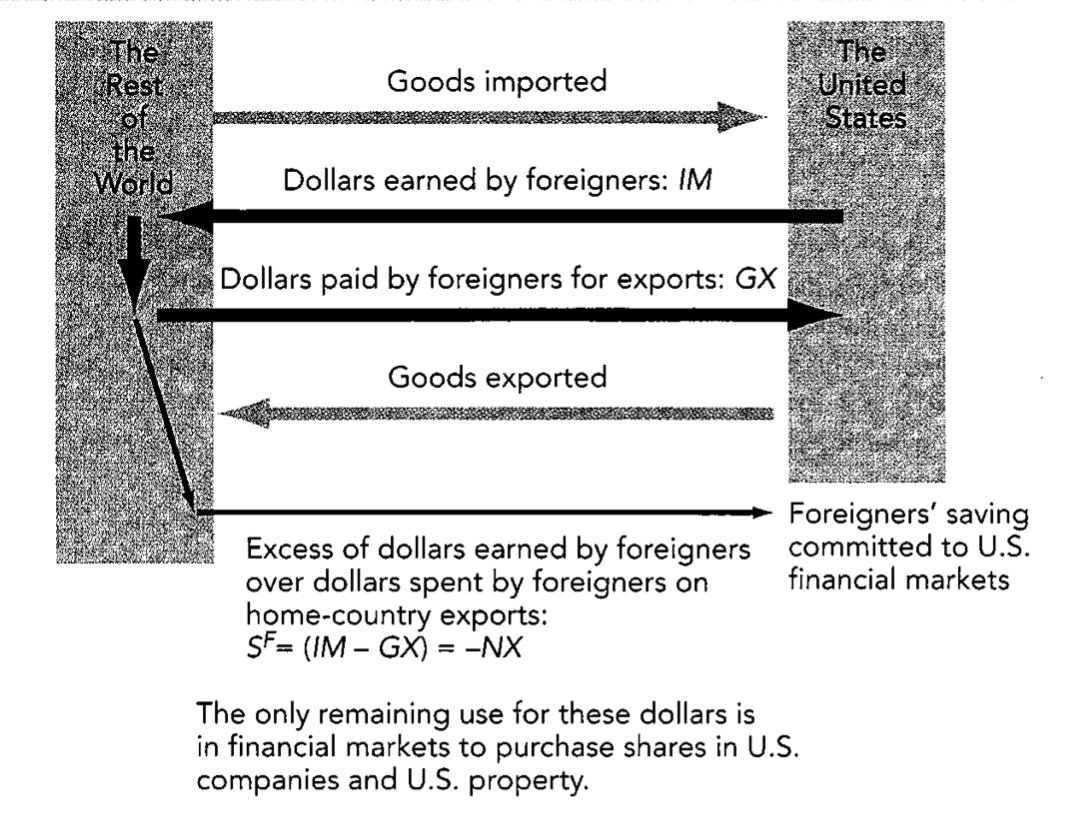

# >**Imports Minus Exports Equals Foreign Saving**: Dollars earned by foreigners from selling us imported goods and services return to the United States either as payments for goods and services we export or as foreign sav ing that flows into U.S. financial markets.

#

#

#

# ### 7.2.4.1 Financial Transactions And The Flow Of Funds: Some Details

#

# The relationship between the funds that flow into and the funds that flow out of financial markets is indirect. When the government runs a surplus, it does not directly lend money to a business that wants to build a new factory. Instead, the government uses the surplus to buy back some of the bonds that it previously issued. The bank that owned those bonds then takes the cash it received from the government and uses it to buy some other financial asset — perhaps bonds issued by a corporation.

#

# Similarly, households or foreigners using financial markets to save rarely buy newly issued corporate bonds. Moreover, they rarely buy shares of stock that are part of an initial public offering. On the rare occasion when they do, they are directly transferring purchasing power to a company undertaking investment. Instead, households and foreigners usually save by purchasing already-existing securities or simply depositing their wealth in a bank.

#

# The relationship between the flows of funds into and out of financial markets is indirect, but it is very real. then the supply and demand in the flow of funds through financial markets balances as well.

#

#

#

# ### 7.2.5 RECAP: Two Approaches, One Model

#

# We can approach equilibrium in two ways.

#

# 1. One is the circular flow of purchasing power approach: In equilibrium, output equals aggregate demand.

#

# 2. The other is the flow-of-funds approach: In equilibrium, saving equals investment.

#

# We can show that these two approaches are equivalent using the circular flow diagram. We can also show they are equivalent algebraically, by starting with one equilibrium condition, Y = AD, and deriving from it the other, 5 = I.

#

# ----

#

#

# ## 7.3 The Real Interest Rate Adjusts to Ensure Equilibrium

#

# In a flexible-price economy, equilibrium exists when aggregate demand equals potential output. But what economic forces will make aggregate demand equal potential output? The determinants of C, I, G, and NX are things like consumers’ optimism, interest rates, the sensitivity of exports to exchange rates, and so on. These determinants seem to have nothing at all to do with the determinants of Y*. It is the form of the production function and the available resources on the sup ply side that determine the level of potential output Y*. So what will make the sum of C, I, G, and NX equal potential output?

#

# The answer is: The real interest rate r plays the key role. If government policy, the international economic environment, or domestic conditions change, then the real interest rate changes in response. In turn, the change in the real interest rate causes changes in investment spending, the exchange rate, and net exports. The real interest rate will continue to change until the economy is again at equilibrium. It is these changes in the real interest rate that ensure that in the long run a flexible- price macroeconomy reaches and stays at equilibrium where aggregate demand equals potential output.

#

# But how could a disequilibrium between aggregate demand and output lead to a change in the real interest rate? Here is where the flow-of-funds approach comes in. Equilibrium with aggregate demand equal to potential output is equivalent to equilibrium with the supply of funds—saving—equal to the demand for funds—investment. When aggregate demand is less than potential output, saving is greater than investment. And when aggregate demand is greater than potential output, investment is greater than saving.

#

# When the supply of funds—saving—is greater than the demand for funds—investment—what will happen? The price of loanable funds—the real interest rate r—will fall. Some financial institutions—banks, mutual funds, venture capitalists, insurance companies, whatever—will find purchasing power piling up as more money flows into their accounts than they can find good projects to commit to. They will try to underbid their competitors. How do they underbid? They underbid by saying that they will accept a lower interest rate than the current real interest rate.

#

# As the real interest rate falls, two things happen. The number and value of investment projects that are profitable rise. Investment spending rises, closing the gap between saving and investment (and, not coincidentally, closing the gap between aggregate demand and potential output). And net exports rise, decreasing foreign saving and further closing the gap between saving and investment (and, again not coincidentally, further closing the gap between aggregate demand and potential output). The process will stop when the interest rate has fallen just enough to make the flow of saving into the financial markets equal to investment. So that’s the big bottom line: The real interest rate ensures equilibrium in the flexible-price model because both investment and saving respond to changes in the real interest rate.

#

#

#

# ###

#

# We can depict these relationships graphically. Investment spending is the demand for loanable funds. As the real interest rate r falls, investment spending I rises.

#

# Total saving is the supply of loanable funds. It has three components: private saving Sp, government saving Sg (which is usually negative), and foreign saving S.

#

# Let’s start with foreign saving. As the real interest rate r falls, foreign saving falls. The intuition is a bit roundabout. As the real domestic interest rate falls, the nominal and real exchange rates rise. When the real exchange rate s rises, gross exports GX rise. When gross exports rise, net exports NX rise, which is the same thing as saying net imports (—NX) fall. When net imports fall, net foreign inflow of financial capital falls. And net foreign inflow of financial capital is just a long phrase for foreign saving. It is important to remember that foreign saving can be either negative or positive. When a country runs a trade surplus, foreign saving is negative. When it runs a trade deficit, as the United States has been doing for many years, foreign saving is positive. To remind ourselves that foreign saving can be negative or positive, we draw the foreign saving curve crossing the vertical axis.

#

#

#

#

#

# >**Imports Minus Exports Equals Foreign Saving**: Dollars earned by foreigners from selling us imported goods and services return to the United States either as payments for goods and services we export or as foreign sav ing that flows into U.S. financial markets.

#

#

#

# ### 7.2.4.1 Financial Transactions And The Flow Of Funds: Some Details

#

# The relationship between the funds that flow into and the funds that flow out of financial markets is indirect. When the government runs a surplus, it does not directly lend money to a business that wants to build a new factory. Instead, the government uses the surplus to buy back some of the bonds that it previously issued. The bank that owned those bonds then takes the cash it received from the government and uses it to buy some other financial asset — perhaps bonds issued by a corporation.

#

# Similarly, households or foreigners using financial markets to save rarely buy newly issued corporate bonds. Moreover, they rarely buy shares of stock that are part of an initial public offering. On the rare occasion when they do, they are directly transferring purchasing power to a company undertaking investment. Instead, households and foreigners usually save by purchasing already-existing securities or simply depositing their wealth in a bank.

#

# The relationship between the flows of funds into and out of financial markets is indirect, but it is very real. then the supply and demand in the flow of funds through financial markets balances as well.

#

#

#

# ### 7.2.5 RECAP: Two Approaches, One Model

#

# We can approach equilibrium in two ways.

#

# 1. One is the circular flow of purchasing power approach: In equilibrium, output equals aggregate demand.

#

# 2. The other is the flow-of-funds approach: In equilibrium, saving equals investment.

#

# We can show that these two approaches are equivalent using the circular flow diagram. We can also show they are equivalent algebraically, by starting with one equilibrium condition, Y = AD, and deriving from it the other, 5 = I.

#

# ----

#

#

# ## 7.3 The Real Interest Rate Adjusts to Ensure Equilibrium

#

# In a flexible-price economy, equilibrium exists when aggregate demand equals potential output. But what economic forces will make aggregate demand equal potential output? The determinants of C, I, G, and NX are things like consumers’ optimism, interest rates, the sensitivity of exports to exchange rates, and so on. These determinants seem to have nothing at all to do with the determinants of Y*. It is the form of the production function and the available resources on the sup ply side that determine the level of potential output Y*. So what will make the sum of C, I, G, and NX equal potential output?

#

# The answer is: The real interest rate r plays the key role. If government policy, the international economic environment, or domestic conditions change, then the real interest rate changes in response. In turn, the change in the real interest rate causes changes in investment spending, the exchange rate, and net exports. The real interest rate will continue to change until the economy is again at equilibrium. It is these changes in the real interest rate that ensure that in the long run a flexible- price macroeconomy reaches and stays at equilibrium where aggregate demand equals potential output.

#

# But how could a disequilibrium between aggregate demand and output lead to a change in the real interest rate? Here is where the flow-of-funds approach comes in. Equilibrium with aggregate demand equal to potential output is equivalent to equilibrium with the supply of funds—saving—equal to the demand for funds—investment. When aggregate demand is less than potential output, saving is greater than investment. And when aggregate demand is greater than potential output, investment is greater than saving.

#

# When the supply of funds—saving—is greater than the demand for funds—investment—what will happen? The price of loanable funds—the real interest rate r—will fall. Some financial institutions—banks, mutual funds, venture capitalists, insurance companies, whatever—will find purchasing power piling up as more money flows into their accounts than they can find good projects to commit to. They will try to underbid their competitors. How do they underbid? They underbid by saying that they will accept a lower interest rate than the current real interest rate.

#

# As the real interest rate falls, two things happen. The number and value of investment projects that are profitable rise. Investment spending rises, closing the gap between saving and investment (and, not coincidentally, closing the gap between aggregate demand and potential output). And net exports rise, decreasing foreign saving and further closing the gap between saving and investment (and, again not coincidentally, further closing the gap between aggregate demand and potential output). The process will stop when the interest rate has fallen just enough to make the flow of saving into the financial markets equal to investment. So that’s the big bottom line: The real interest rate ensures equilibrium in the flexible-price model because both investment and saving respond to changes in the real interest rate.

#

#

#

# ###

#

# We can depict these relationships graphically. Investment spending is the demand for loanable funds. As the real interest rate r falls, investment spending I rises.

#

# Total saving is the supply of loanable funds. It has three components: private saving Sp, government saving Sg (which is usually negative), and foreign saving S.

#

# Let’s start with foreign saving. As the real interest rate r falls, foreign saving falls. The intuition is a bit roundabout. As the real domestic interest rate falls, the nominal and real exchange rates rise. When the real exchange rate s rises, gross exports GX rise. When gross exports rise, net exports NX rise, which is the same thing as saying net imports (—NX) fall. When net imports fall, net foreign inflow of financial capital falls. And net foreign inflow of financial capital is just a long phrase for foreign saving. It is important to remember that foreign saving can be either negative or positive. When a country runs a trade surplus, foreign saving is negative. When it runs a trade deficit, as the United States has been doing for many years, foreign saving is positive. To remind ourselves that foreign saving can be negative or positive, we draw the foreign saving curve crossing the vertical axis.

#

#

#

#  #

# >**The Demand for Loanable Funds**: The demand for loanable funds is investment de mand. When the real interest rate falls, the number and value of prof itable investment projects rise, increasing businesses' demand for loanable funds to finance investment.

#

#

#

#

#

# >**The Demand for Loanable Funds**: The demand for loanable funds is investment de mand. When the real interest rate falls, the number and value of prof itable investment projects rise, increasing businesses' demand for loanable funds to finance investment.

#

#

#

#  #

# >**Foreign Saving: The Supply of Loanable Funds from Foreigners**: The supply of loanable funds from foreigners is foreign saving. When the domestic real interest rate falls, foreigners will move some funds out of dollar- denominated assets and into assets denominated in other currencies, decreasing foreign saving as nominal and real exchange rates rise.

#

#

#

#

#

# >**Foreign Saving: The Supply of Loanable Funds from Foreigners**: The supply of loanable funds from foreigners is foreign saving. When the domestic real interest rate falls, foreigners will move some funds out of dollar- denominated assets and into assets denominated in other currencies, decreasing foreign saving as nominal and real exchange rates rise.

#

#

#

#  #

# >**Private and Government Supply of Loanable Funds**: Private saving Sp does not change when the real interest rate r changes. The distance from the vertical axis to the household saving line measures the amount of funds that flow into financial markets from households. If households dissave, so that SH is negative, the household saving line is to the left of zero. Government saving Sg also does not change when the real interest rate r changes. The distance from the vertical axis to the government saving line would measure the amount of funds that flow from financial markets to the government. If the government runs a deficit, so that SGis negative, the government saving line is to the left of zero.

#

#

#

#

#

# >**Private and Government Supply of Loanable Funds**: Private saving Sp does not change when the real interest rate r changes. The distance from the vertical axis to the household saving line measures the amount of funds that flow into financial markets from households. If households dissave, so that SH is negative, the household saving line is to the left of zero. Government saving Sg also does not change when the real interest rate r changes. The distance from the vertical axis to the government saving line would measure the amount of funds that flow from financial markets to the government. If the government runs a deficit, so that SGis negative, the government saving line is to the left of zero.

#

#

#

#  #

# >**Total Saving: The Supply of Loanable Funds**: Total saving is the sum of foreign, household, and government saving. Total saving increases as the real interest rate rises because of the relationship between the real interest rate and foreign saving.

#

#

#

# Private saving is another component of total saving. It is what’s left over after net taxes T and consumption C have been subtracted from household income. Consumption spending depends on income, as do net taxes. But as we noted in Appendix 6a, real interest rates do not affect consumption. And because we are assuming that household income is always equal to potential output Y*, which depends on the supplies of inputs and the production function, then income is not dependent on the real interest rate. And since neither the tax rate nor income depends on the real interest rate, net taxes don’t change when the real interest rate changes. So private saving Sp does not change when the real interest rate changes. We show the relationship between household saving and the real interest rate as a vertical line.

#

# Government saving Sg is the final component of total saving. But its value also does not depend on the value of the real interest rate. So here again, we would show the relationship between government saving and the real interest rate as a vertical line. If government saving was negative—if the government was running a deficit—then the government saving line would be to the left of zero.

#

# Total saving is the sum of foreign, household, and government saving. Graphically, we take the foreign saving line, shift it over by the amount of household saving, and shift it over again—or in the case of a government budget deficit shift it back—by the amount of government saving. This gives us the relationship between total saving S and the real interest rate

#

# We now have the two sides of the loanable funds market. The demand for loanable funds is investment spending. The supply of loanable funds is total saving. Bring them together to see the market for loanable funds. When total saving S equals investment demand I, the market for loanable funds is in equilibrium.

#

#

#

# ### 7.3.2 The Adjustment to Flow-of-Funds Equilibrium

#

# Suppose that the real interest rate is initially greater than the equilibrium real interest rate. Saving will exceed investment by the amount labeled “excess saving.” Some lenders will offer to accept a lower inter est rate. As interest rates fall, investment spending will increase, moving along the investment demand curve. And as interest rates fall, foreign saving will fall, moving along the total saving curve. The macroeconomy will move to the equilibrium interest rate, where saving equals investment. And, as we showed above, when saving equals investment, aggregate demand equals potential output. When prices are fully flexible, the real interest rate adjusts to ensure full employment.

#

#

#

#

#

# >**Total Saving: The Supply of Loanable Funds**: Total saving is the sum of foreign, household, and government saving. Total saving increases as the real interest rate rises because of the relationship between the real interest rate and foreign saving.

#

#

#

# Private saving is another component of total saving. It is what’s left over after net taxes T and consumption C have been subtracted from household income. Consumption spending depends on income, as do net taxes. But as we noted in Appendix 6a, real interest rates do not affect consumption. And because we are assuming that household income is always equal to potential output Y*, which depends on the supplies of inputs and the production function, then income is not dependent on the real interest rate. And since neither the tax rate nor income depends on the real interest rate, net taxes don’t change when the real interest rate changes. So private saving Sp does not change when the real interest rate changes. We show the relationship between household saving and the real interest rate as a vertical line.

#

# Government saving Sg is the final component of total saving. But its value also does not depend on the value of the real interest rate. So here again, we would show the relationship between government saving and the real interest rate as a vertical line. If government saving was negative—if the government was running a deficit—then the government saving line would be to the left of zero.

#

# Total saving is the sum of foreign, household, and government saving. Graphically, we take the foreign saving line, shift it over by the amount of household saving, and shift it over again—or in the case of a government budget deficit shift it back—by the amount of government saving. This gives us the relationship between total saving S and the real interest rate

#

# We now have the two sides of the loanable funds market. The demand for loanable funds is investment spending. The supply of loanable funds is total saving. Bring them together to see the market for loanable funds. When total saving S equals investment demand I, the market for loanable funds is in equilibrium.

#

#

#

# ### 7.3.2 The Adjustment to Flow-of-Funds Equilibrium

#

# Suppose that the real interest rate is initially greater than the equilibrium real interest rate. Saving will exceed investment by the amount labeled “excess saving.” Some lenders will offer to accept a lower inter est rate. As interest rates fall, investment spending will increase, moving along the investment demand curve. And as interest rates fall, foreign saving will fall, moving along the total saving curve. The macroeconomy will move to the equilibrium interest rate, where saving equals investment. And, as we showed above, when saving equals investment, aggregate demand equals potential output. When prices are fully flexible, the real interest rate adjusts to ensure full employment.

#

#

#

#  #

# >**Equilibrium in the Flow of Loanable Funds**: The market for loanable funds is in equilibrium when the supply of loanable funds—total saving S—equals the demand for loanable funds—investment demand.

#

#

#

#

#

# >**Equilibrium in the Flow of Loanable Funds**: The market for loanable funds is in equilibrium when the supply of loanable funds—total saving S—equals the demand for loanable funds—investment demand.

#

#

#

#  #

# >**Excess Saving in the Market for Loanable Funds**

#

#

#

# ### 7.3.3 RECAP: The Real Interest Rate Adjusts to Ensure Equilibrium

#

# In the flexible-price model, the real interest rate is the price that equilibrates the market for loadable funds—the place where saving flows into and investment financing flows out of financial markets. What happens if the flow of funds does not balance—if at the current real interest rate, the flow of saving into the financial markets exceeds the demand by corporations and others for purchasing power to finance investment? Then the price of loans—the real interest rate—will fall, until the supply of funds—saving—equals the deriiand for funds—investinent. Conversely, if investment demand exceeds saving, the real interest rate will rise. When the real interest rate is at its equilibrium value, saving equals investment: S = I. Moreover, aggregate demand equals full-employment real GDP: AD = Y*.

#

# ----

#

#

# ## 7.4 Using the Model: What Makes the Real Interest Rate Change?

#

# We can use this graphical way of looking at the flow of funds to figure out what happens to the equilibrium real interest rate when there is some change in the eco nomic environment or in economic policy. Some changes make either the saving or the investment curve shift. Other changes also affect the slope of the saving or investment curve. When one or both of the curves shift or change slope, there will be a new equilibrium real interest rate.

#

# Let’s take a look:

#

#

#

# ###

#

# >**A Decrease in Saving Increases the Real Interest Rate**: When government purchases rise or taxes are cut, government saving is lowered. The drop in total saving leads to higher real interest rates, increased financing of investment by foreigners, and a fall in investment spending by businesses. Economists worry about the long-run effects of rising govern ment deficits because of their effect on capital accumulation.

#

#

#

# A drop in household saving Sp would be analyzed the same way, as would a drop in foreign saving SF that occurred at every interest rate. In both of these cases, the total saving curve shifts to the left, raising the real interest rate, increasing foreign saving slightly to offset part but not all of the initial drop in saving, and decreasing investment demand.

#

# A tax cut has a slightly different effect. It is very like the effect of a government purchases increase. But because a tax cut increases disposable income and the mar ginal propensity to consume is less than 1, there is one difference. The difference is that a portion of the addition to household income from the tax cut shows up as household saving. So the initial shift to the left of the total saving curve is smaller than the drop in government saving by the amount of this change in house hold saving. Otherwise the effects are very similar: Like a government purchases increase, a tax cut leads to an increase in the interest rate, a rise in foreign saving, and a fall in investment spending.

#

# Why do economists make such a big deal out of a decrease in government saving—whether it’s due to a decrease in taxes or an increase in government purchases? Because as Figure 7.10 illustrates, in the long run, a decrease in gov ernment saving—an increase in the budget deficit—makes interest rates rise, which reduces investment spending. And remember one of the lessons of the standard of living. In the long run, increases in government borrowing “crowd out"—reduce-—investment spending, which, all else equal, slows the country’s rate of economic growth while the economy adjusts to a lower balanced-growth path.

#

#

#

# ### 7.4.2 The Effect of a Change in Investment Demand

#

# We can also use the flow-of-funds graph to see the effect of an increase in investment I. Suppose that businesses suddenly become more optimistic about the future and increase the amount they wish to spend on new plant and equipment (as they did in the late 1990s). What would be the effect of such a domestic investment boom?

#

# Investment—the demand-for-loanable-funds curve—shifts to the right. At the initial interest rate, investment demand now exceeds saving. Firms that wish to increase their investment spending will bid up interest rates as they compete for scarce loans.

#

# As interest rates rise, two things simultaneously happen:

#

# * One, other firms will decrease their investment spending because their planned investment projects are no longer profitable at these now-higher interest rates—a movement along the new investment demand curve.

#

# * Two, the higher real interest rate leads to a fall in the real exchange rate, to a fall in net exports, and thus to an increase in foreign saving flowing into domestic financial markets—a movement along the saving curve. In the end, the loanable funds market settles at a higher interest rate with an increased level of saving and investment.

#

# Notice what happened: The higher interest rates due to the first shift in investment led to a subsequent decrease in investment that partly—but not entirely—offset the initial shift. So investment did increase. What made the increase in investment possible? The increase in foreign saving. If saving had not increased in reaction to the higher interest rates, investment could not increase.

#

# Without an increase in saving, the shift in investment demand would make interest rates rise so much that investment spending would fall right back to its initial position. Instead, when foreign saving increases with real interest rates, both saving and investment increase in response to increased business optimism.

#

#

#

#

#

# >**Excess Saving in the Market for Loanable Funds**

#

#

#

# ### 7.3.3 RECAP: The Real Interest Rate Adjusts to Ensure Equilibrium

#

# In the flexible-price model, the real interest rate is the price that equilibrates the market for loadable funds—the place where saving flows into and investment financing flows out of financial markets. What happens if the flow of funds does not balance—if at the current real interest rate, the flow of saving into the financial markets exceeds the demand by corporations and others for purchasing power to finance investment? Then the price of loans—the real interest rate—will fall, until the supply of funds—saving—equals the deriiand for funds—investinent. Conversely, if investment demand exceeds saving, the real interest rate will rise. When the real interest rate is at its equilibrium value, saving equals investment: S = I. Moreover, aggregate demand equals full-employment real GDP: AD = Y*.

#

# ----

#

#

# ## 7.4 Using the Model: What Makes the Real Interest Rate Change?

#

# We can use this graphical way of looking at the flow of funds to figure out what happens to the equilibrium real interest rate when there is some change in the eco nomic environment or in economic policy. Some changes make either the saving or the investment curve shift. Other changes also affect the slope of the saving or investment curve. When one or both of the curves shift or change slope, there will be a new equilibrium real interest rate.

#

# Let’s take a look:

#

#

#

# ###

#

# >**A Decrease in Saving Increases the Real Interest Rate**: When government purchases rise or taxes are cut, government saving is lowered. The drop in total saving leads to higher real interest rates, increased financing of investment by foreigners, and a fall in investment spending by businesses. Economists worry about the long-run effects of rising govern ment deficits because of their effect on capital accumulation.

#

#

#

# A drop in household saving Sp would be analyzed the same way, as would a drop in foreign saving SF that occurred at every interest rate. In both of these cases, the total saving curve shifts to the left, raising the real interest rate, increasing foreign saving slightly to offset part but not all of the initial drop in saving, and decreasing investment demand.

#

# A tax cut has a slightly different effect. It is very like the effect of a government purchases increase. But because a tax cut increases disposable income and the mar ginal propensity to consume is less than 1, there is one difference. The difference is that a portion of the addition to household income from the tax cut shows up as household saving. So the initial shift to the left of the total saving curve is smaller than the drop in government saving by the amount of this change in house hold saving. Otherwise the effects are very similar: Like a government purchases increase, a tax cut leads to an increase in the interest rate, a rise in foreign saving, and a fall in investment spending.

#

# Why do economists make such a big deal out of a decrease in government saving—whether it’s due to a decrease in taxes or an increase in government purchases? Because as Figure 7.10 illustrates, in the long run, a decrease in gov ernment saving—an increase in the budget deficit—makes interest rates rise, which reduces investment spending. And remember one of the lessons of the standard of living. In the long run, increases in government borrowing “crowd out"—reduce-—investment spending, which, all else equal, slows the country’s rate of economic growth while the economy adjusts to a lower balanced-growth path.

#

#

#

# ### 7.4.2 The Effect of a Change in Investment Demand

#

# We can also use the flow-of-funds graph to see the effect of an increase in investment I. Suppose that businesses suddenly become more optimistic about the future and increase the amount they wish to spend on new plant and equipment (as they did in the late 1990s). What would be the effect of such a domestic investment boom?

#

# Investment—the demand-for-loanable-funds curve—shifts to the right. At the initial interest rate, investment demand now exceeds saving. Firms that wish to increase their investment spending will bid up interest rates as they compete for scarce loans.

#

# As interest rates rise, two things simultaneously happen:

#

# * One, other firms will decrease their investment spending because their planned investment projects are no longer profitable at these now-higher interest rates—a movement along the new investment demand curve.

#

# * Two, the higher real interest rate leads to a fall in the real exchange rate, to a fall in net exports, and thus to an increase in foreign saving flowing into domestic financial markets—a movement along the saving curve. In the end, the loanable funds market settles at a higher interest rate with an increased level of saving and investment.

#

# Notice what happened: The higher interest rates due to the first shift in investment led to a subsequent decrease in investment that partly—but not entirely—offset the initial shift. So investment did increase. What made the increase in investment possible? The increase in foreign saving. If saving had not increased in reaction to the higher interest rates, investment could not increase.

#

# Without an increase in saving, the shift in investment demand would make interest rates rise so much that investment spending would fall right back to its initial position. Instead, when foreign saving increases with real interest rates, both saving and investment increase in response to increased business optimism.

#

#

#

#  #

# >**An Increase in Investment Also Increases the Real Interest Rate**: Increased investment demand leads to higher real interest rates, which dampen business enthusiasm for new investment projects while increasing financing of investment by foreigners.

#

#

#

# ### 7.4.3 RECAP: Using the Model: What Makes the Real Interest Rate Change?

#

# We can use the graphical approach to flow-of-funds equilibrium to see that an increase in saving or a decrease in investment—shifts to the right in the sav ing curve or to the left in the investment demand curve—would lead to a fall in the real interest rate. And a decrease in saving or an increase in investment would make the real interest rate rise. When the supply of saving shifts, the ultimate change in saving will be smaller than the initial change in saving. When investment demand shifts, the ultimate change in investment will be smaller than the initial change in investment. In both cases, this is due to changes in the real interest rate which induce movements along the saving and investment curves that partly offset the initial shifts.

#

# ----

#

#

# ## 7.5 Calculating the Equilibrium Real Interest Rate: Algebra

#

# The flow-of-funds graphs let us figure out whether interest rates rise or fall in reaction to a change in policy or economic environment that affects investment demand or total saving. But what if we are policy makers who want to know the precise value of the real interest rate at equilibrium, and by how much the interest rate will change if we implement some policy? To figure out the value of the interest rate and how much it changes in reaction to a change in policy or economic envi ronment, we need to do some algebra.

#

# What we need are the equations for total saving S and for investment demand I. Equilibrium occurs when saving S equals investment I, so we will just set the equa tions equal to each other. Then we solve for the real interest rate.

#

# This sounds straightforward—and it is. But the equations can get quite messy. Don’t get discouraged. If the notation and the algebra get to be a bit much, remem ber that all we’re doing is setting saving equal to investment and solving for r.

#

#

#

# ### 7.5.1 The Formula for the Equilibrium Real Interest Rate

#

# Start with total saving S, which is the sum of private saving Sp, government saving Sg, and foreign saving Sf:

#

# > $ S = S^p + S^g + S^f $

#

# Private saving is equal to total income Y minus net taxes T minus consumption spending C. But since we are in a world of flexible prices (that’s our assumption in this chapter, remember), total income Y is always equal to potential output Y*. Consumption spending depends on baseline consumption c0, the marginal propensity to consume cy, the tax rate t, and potential income Y*. Remember, net taxes are a constant proportion of income: T = tY. Thus:

#

# > $ S^p = Y^* - T - C = Y^* - tY^* - \left(c_0 + c_y(1-t)Y^*\right) $

#

# Government saving is equal to net taxes T minus government purchases G.

#

# > $ S^g = T - G = tY^* - G $

#

# Note that neither private saving nor government saving depends on the real interest rate. That is why we graph private saving Sp and government saving Sg as vertical lines on every graph with the interest rate r on the vertical axis.

#

# On the other side of the flow-of-funds equilibrium equation, demand for funds is simply investment spending, which depends on animal spirits $ I_0 $, the sensitivity of investment spending to the real interest rate $ I_r $, and the level of the real interest rate r. When the real interest rate r rises, investment spending I falls:

#

# > $ I = I_0 - \left(I_r\right)r $

#

#

#

# #### 7.5.1.1 If Trade Were Balanced

#

# Suppose trade were balanced. Then foreign savings Sf would be zero. And our flow-of-funds equilibrium equation would become:

#

# > $ S^p + S^g + 0 = Y^* - tY^* - \left(c_0 + c_y(1-t)Y^*\right) + tY^* - G = I $

#

# Which simplifies to:

#

# > $ Y^* - c_0 - c_y(1-t)Y^* - G = I_0 - \left(I_r\right)r $

#

# And solving for r:

#

# > $ r^* = \frac{I_0 + c_0 + \left[(1-t)c_y - 1\right]Y^*}{I_r} $

#

# At this value of $ r^* $, domestic aggregate demand is equal to Y*—enough to carry employment to full employment and production to potential output.

#

#

#

# #### 7.5.1.2 But Trade Is Not Balanced

#

# However, trade is not balanced. So what about foreign saving Sf?

#

# Foreign saving is imports minus exports. The determinants of foreign saving are three parameters—the propensity to import imy, foreigners’ propensity to buy exports xf, and the sensitivity of exports to the exchange rate $ x_{\epsilon} $—and three variables: foreign incomes Yf, domestic total income Y*, and the exchange rate $ \epsilon $:

#

# > $ S^f = -NX = {im_y}Y^* - {x_f}Y^f - x_{\epsilon}\epsilon $

#

# And it is the exchange rate that changes when the real interest rate r changes:

#

# > $ \epsilon = {\epsilon}_0 - {{\epsilon}_r}(r- r^f) $

#

# where the real exchange rate $ \epsilon $ depends on the baseline value of the real exchange rate, the sensitivity of the real exchange rate to changes in interest rates, the domestic real interest rate r, and the foreign real interest rate $ r^f $.

#

# Thus, because foreign saving depends on the exchange rate, and because the exchange rate depends on the interest rate, foreign saving Sf depends on the real interest rate r. When the real interest rate rises, the total saving flow increases. Why? Because an increase in the real interest rate attracts foreign capital into domestic financial markets and increases foreign saving:

#

# > $ S^f = -NX = {im_y}Y^* - {x_f}Y^f - x_{\epsilon}\left({\epsilon}_0 - {{\epsilon}_r}(r- r^f)\right) $

#

# The flow-of-funds equilibrium is where supply and demand balance: where

# total saving is equal to investment spending. So now we solve this equation for r*, the equilibrium real interest rate, which will equal:

#

# > $ r^* = \frac{I_0 + G + c_0 - \left[1 - (1-t)c_y + im_y\right]Y^* + {x_f}Y^f + x_{\epsilon}\left({\epsilon}_0 + {{\epsilon}_r}r^f\right)}

# {I_r + x_{\epsilon}{\epsilon}_r} $

#

# This equation is a little unappetizing: you cannot be expected to remember it.

#

# It is, however, worthwhile because you can refer to it. And referring to it will allow you to analyze what pretty much any sudden shock will do or what pretty much any counterfactual scenario will mean for a flexprice economy.

#

#

# #### 7.5.1.3 Deriving the Equilibrium Interest Rate Equation

#

# Unless you are fascinated, feel welcome to skip this subsection. It is important to get the intuition: the interest rate shifts up or down to keep the flow-of-funds through financial markets in supply-and-demand balance, and that rapidly drives the flexprice economy to its full-employment production-equal-to-potential equilibrium. But the details are to be referred to when needed, not memorized: there are better things to keep in your brain in these days of high information technology.

#

# To derive the equation for the equilibrium real interest rate, we start from either the flow-of-output or the flow-of-funds equilibrium statement:

#

# > $ Y = C + l + G + NX $ or $ S^p + S^g + S^f = I $

#

# They are eqiuivalent. Many students like to start from $ Y=C+f+G+ NX $ simply because it is more familiar. If you do, you will have to plug-and-chug in a slightly different way, for here we begin with the flow-of-funds equilibrium equation:

#

# > $ S^p + S^g + S^f = I $

#

# Recall that private saving, taxes, and consumption spending are:

#

# > $ S^p = Y - T - C $

#

# > $ T = tY $

#

# > $ C = c_0 + c_y(1-t)Y $

#

# Substituting gives us:

#

# > $ S^p = Y - tY - c_0- c_y(1 - t)Y $

#

# Recall that government saving is:

#

# > $ S^g = T - G = tY - G $

#

# And recall that foreign saving is:

#

# > $ S^f = IM - GX = - NX = (im_y)Y - (x_fY^f + x_{\epsilon}{\epsilon}) $

#

# Plugging in for the components of the savings flow-of-funds into financial markets gives us:

#

# > $ (Y - tY - c_0 - c_y(1 - t)Y) + (tY - G) + ((im_y)Y - (x_fY^f + x_{\epsilon}{\epsilon})) = I $

#

# We can simplify this a little:

#

# > $ (1-im_y - c_y(1-t))Y - c_0 - G - x_fY^f - x_{\epsilon}{\epsilon} = I $

#

# Investment spending is:

#

# > $ I = I_0 - I_rr $

#

# Plugging in:

#

# > $ (1-im_y - c_y(1-t))Y - c_0 - G - x_fY^f - x_{\epsilon}{\epsilon} = I_0 - I_rr $

#

# Recall the exchange rate:

#

# > $ \epsilon = {\epsilon}_0 + {\epsilon}_r(r^f - r) $

#

# Plug it in:

#

# > $ (1-im_y - c_y(1-t))Y - c_0 - G - x_fY^f - x_{\epsilon}({\epsilon}_0 + {\epsilon}_r(r^f - r)) = I_0 - I_rr $

#

# Separating out the terms with r in them:

#

# > $ I_rr + x_{\epsilon}{\epsilon}_rr = c_0 + I_0 + G + x_fY^f + x_{\epsilon}{\epsilon}_0 + x_{\epsilon}{\epsilon}_rr^f - (1-im_y - c_y(1-t))Y $

#

# and dividing through:

#

# > $ r^* = \frac{I_0 + G + c_0 - \left[1 - (1-t)c_y + im_y\right]Y^* + {x_f}Y^f + x_{\epsilon}\left({\epsilon}_0 + {{\epsilon}_r}r^f\right)}

# {I_r + x_{\epsilon}{\epsilon}_r} $

#

# And so we are done.

#

# Once agai: It is important to get the intuition: the interest rate shifts up or down to keep the flow-of-funds through financial markets in supply-and-demand balance, and that rapidly drives the flexprice economy to its full-employment production-equal-to-potential equilibrium. But the details are to be referred to when needed, not memorized: there are better things to keep in your brain in these days of high information technology.

#

#

#

# ### 7.5.2 Interpreting the Equilibrium Real Interest Rate Equation

#

# What does this equation:

#

# > $ r^* = \frac{I_0 + G + c_0 - \left[1 - (1-t)c_y + im_y\right]Y^* + {x_f}Y^f + x_{\epsilon}\left({\epsilon}_0 + {{\epsilon}_r}r^f\right)}

# {I_r + x_{\epsilon}{\epsilon}_r} $

#

# say?

#

# First look at the numerator. When $ I_0 $ increases—when business "animal spirits" rise as those sitting on businesses' investment approval committees get more optimistic and excited—the real interest rate r will increase. A rise in $ I_0 $ is an increase in the demand for financing in the loanable funds market—and when demand goes up, the price, which is the real interest rate $ r $, tends to rise.

#

# When $ G $ increases—when the government spends more and borrows more in order to finance its spending, thus decreasing public saving—the real interest rate $ r $ will rise. When $ c_0 $ gets larger—when consumers get more confident and are more eager to spend on consumption goods, thus reducing private saving—the real interest rate $ r $ will rise. And when incomes abroad $ Y^f $ rise, thus boosting demand for our exports and redirecting dollars earned from our imports away from invsetment in America, thus reducing foreign saving, the real interest rate $ r $ will rise. All three of these are reductions in saving: in government saving, private saving, and foreign saving, respectively. And when the supply of savings flowing into the loanable funds market declines, the price, which is the real interest rate $ r $, tends to rise.

#

# Were $ Y $ to increase—it usually does not rise in calculations involving the flexprice model, as supply-and-demand balance in the labor market enforces $ Y = Y^* $, output equal to potential—the price in the flow-of-funds through the financial market, the real interest rate $ r $, would decline. Other things being equal, a richer country would save more, by an amount equal to a fraction $ (1-im_y - c_y(1-t)) $ times the increase in national income, and such an increase in savings supply would lower the price that is the real interest rate $ r $.

#

# By how much does the real interest rate rise in respone to such changes in economic policy and in the economic environment? We get the answer to this question by looking at the denominator: $ I_r + x_{\epsilon}{\epsilon}_r $. The larger the denominator, the smaller the incressse in the real interest rate $ r $ when business animal spirits or any other factor tending to raise it rises. Why? The first term $ I_r $ captures the change in investment due to a change in the real interest rate. The larger the sensitivity of investment to interest rates $ I_r $, the flatter the investment demand curve; the more quickly and farther investment spending will fall in response to a rise in interest rates as the economy moves along a flatter investment demand-for-financing curve. Thus the smaller will be the rise in interest rates needed to restore equilibrium in the flow-of-funds through the financial market.

#

# The second term $ x_{\epsilon}{\epsilon}_r $ tells us how much foreigners' desired investments in America change in response to a change in the real interest rate $ r $. With a higher real interest rate foreign savings invested in America are more profitable, hence foreigners want to undertake more of them. The larger is the product $ x_{\epsilon}{\epsilon}_r $, the flatter is the total saving curve on a graph with total savings $ S^p + S^g + S^f $ on the horizontal and the real interest rate $ r $ on the vertical axis; the larger is the change in foreign saving when the real interest rate rises as the economy moves along a flatter savings supply-of-finance curve. And the larger the relative change in foreign saving, the less the real interest rate $ r $ will be pulled up.

#

#

#

# >**An Increase in Investment Also Increases the Real Interest Rate**: Increased investment demand leads to higher real interest rates, which dampen business enthusiasm for new investment projects while increasing financing of investment by foreigners.

#

#

#

# ### 7.4.3 RECAP: Using the Model: What Makes the Real Interest Rate Change?

#

# We can use the graphical approach to flow-of-funds equilibrium to see that an increase in saving or a decrease in investment—shifts to the right in the sav ing curve or to the left in the investment demand curve—would lead to a fall in the real interest rate. And a decrease in saving or an increase in investment would make the real interest rate rise. When the supply of saving shifts, the ultimate change in saving will be smaller than the initial change in saving. When investment demand shifts, the ultimate change in investment will be smaller than the initial change in investment. In both cases, this is due to changes in the real interest rate which induce movements along the saving and investment curves that partly offset the initial shifts.

#

# ----

#

#

# ## 7.5 Calculating the Equilibrium Real Interest Rate: Algebra

#

# The flow-of-funds graphs let us figure out whether interest rates rise or fall in reaction to a change in policy or economic environment that affects investment demand or total saving. But what if we are policy makers who want to know the precise value of the real interest rate at equilibrium, and by how much the interest rate will change if we implement some policy? To figure out the value of the interest rate and how much it changes in reaction to a change in policy or economic envi ronment, we need to do some algebra.

#

# What we need are the equations for total saving S and for investment demand I. Equilibrium occurs when saving S equals investment I, so we will just set the equa tions equal to each other. Then we solve for the real interest rate.

#

# This sounds straightforward—and it is. But the equations can get quite messy. Don’t get discouraged. If the notation and the algebra get to be a bit much, remem ber that all we’re doing is setting saving equal to investment and solving for r.

#

#

#