Alejandro Correa Bahnsen

# ## #

#  #

#

#

#  #

#

#  #

#

#

#  #

# # #

#

#  #

# # #

| # # | ## al.bahnsen@gmail.com # |

| # # # # | # http://github.com/albahnsen # # |

| # # # | # http://linkedin.com/in/albahnsen # # |

| # # # | # @albahnsen # # |

|

|  |

# |:-:|:-:|

# | Just fund a bank | Just quit college |

#

#

# # Nice guess!

#

# |

|

# |:-:|:-:|

# | Just fund a bank | Just quit college |

#

#

# # Nice guess!

#

# |  |

|  |

# |:-:|:-:|

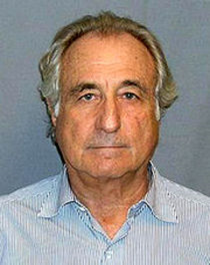

# | Biggest Ponzi scheme | Now a Billionaire |

#

#

# # Credit Scoring

# - Mitigate the impact of **credit risk** and make more objective

# and accurate decisions

# - Estimate the **risk of a customer defaulting** his contracted

# financial obligation if a loan is granted, based on past

# experiences

# - Different machine learning methods are used in practice, and in the

# literature: logistic regression, neural networks, discriminant

# analysis, genetic programing, decision trees, random forests among others

# # Credit Scoring

# Formally, a credit score is a statistical model that allows the estimation of the probability of a customer $i$ defaulting a contracted debt ($y_i=1$)

#

# $$\hat p_i=P(y_i=1|\mathbf{x}_i)$$

#

|

# |:-:|:-:|

# | Biggest Ponzi scheme | Now a Billionaire |

#

#

# # Credit Scoring

# - Mitigate the impact of **credit risk** and make more objective

# and accurate decisions

# - Estimate the **risk of a customer defaulting** his contracted

# financial obligation if a loan is granted, based on past

# experiences

# - Different machine learning methods are used in practice, and in the

# literature: logistic regression, neural networks, discriminant

# analysis, genetic programing, decision trees, random forests among others

# # Credit Scoring

# Formally, a credit score is a statistical model that allows the estimation of the probability of a customer $i$ defaulting a contracted debt ($y_i=1$)

#

# $$\hat p_i=P(y_i=1|\mathbf{x}_i)$$

#  #

#  #

# | # # | ## al.bahnsen@gmail.com # |

| # # # # | # http://github.com/albahnsen # # |

| # # # | # http://linkedin.com/in/albahnsen # # |

| # # # | # @albahnsen # # |